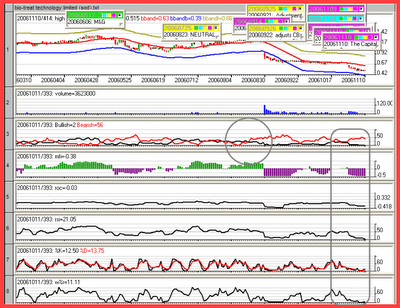

Breaking up from a symmetrical triangle? Possible near-term targets 0.18, 0.22.

Asia Dekor ($0.140, 17 Nov 2006):

AD has been range bounding for quite some time, but on 02 Nov, it suddenly shot up to $0.16 with 19m shares traded. The increased volume since then may suggest that there is renewed interest in AD:

Some trading ideas:

1. Undervalued Stock

• Closing price as at 14/11/2006 = S$0.14

• PER = 6.5 (Based on 1H-FY2007 EPS of RMB0.0534 (S$0.0107))

• Price/NAV per share = 0.8 (Based on NAV as at 30/9/2006 of RMB 0.8741 (S$0.175))

• Dividend yield = 3.14% (Based on the interim dividend of RMB0.011)

2. Strong & Positive Cashflow

• Major capital projects were completed over the past 2 years.

• EBITDA for 1H-FY2007 = RMB83.6 million

3. Proven Profit Track Record

• Strong revenue growth in 1H-FY2007

• Profit after tax stood at RMB47.3 million for 1H-FY2007

4. Strong Product Brand

• Power Dekor brand ranks 130th among China’s top 500 most valuable brands in 2006

• Power Dekor brand ranked 1st in China laminated floor sales for 8 consecutive years from 1998 to 2005

Background:

Asia Dekor Holdings Limited has been listed on the main board of the Singapore Exchange Securities Trading Limited since November 1999. It is the largest producer and distributor of laminated floor and related products in China and is recognised as one of Asia's leading floor manufacturing companies. The Group operates a 45,000 sq m factory based in Shenzhen, China, with a current maximum production capacity of 16 million sq m of laminated floor products. Joined with a new business partner, the Group operates a nationwide distribution network and up to 31 March 2003, there are more than 700 outlets in operation. The major shareholder of the Company is Hi-Power Management Ltd, an investment holding company.

Historical EPS ($) 0.02390

Rolling EPS ($) 0.02428

NAV ($) 0.1805

Historical PE 5.858

Rolling PE 5.766

Price / NAV 0.776

Dividend ($) 0.00524452

Weeks High 0.215

Dividend Yield (%) 3.74652

Weeks Low 0.085

Market Cap (M) 124.816

Issued & Paid-up Shares c891,544,000