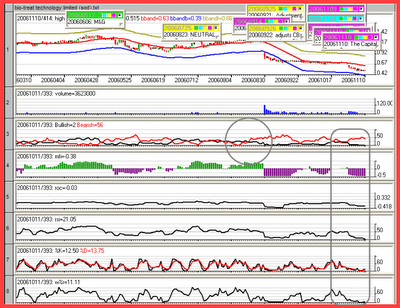

Another Cup and Handle break out?

Background:

Historical EPS ($) 0.02290

Rolling EPS ($) 0.02009

NAV ($) 0.0558

Historical PE6.114

Rolling PE 6.969

Price / NAV 2.509

Dividend ($) 0.004500

52 Weeks High 0.155

Dividend Yield (%) d 3.214

52 Weeks Low 0.105

Market Cap (M) 743.063

Issued & Paid-up Shares 5,307,591,000

The company was incorporated in Singapore on 28 July 1997 as the Group's holding company under the name of Teamsphere Pte Ltd. It changed its name to Teamsphere Limited on 17 March 1999.On 24 September 2004, Teamsphere entered into an agreement with Best Decade Holdings Limited to acquire the entire issued and paid-up share capital of Asia Paragon International Limited. The purchase consideration amounts to S$367.5 million and is to be satisfied in full by the allotment and issuance of 4.9 billion new ordinary shares. Subsequent to the acqusition, the company was renamed to Delong Holdings Limited.Delong Holdings Limited has two wholly-owned subsidiary companies:1) Asia Paragon International Limited 2) Dexin Steel Pte LtdAsia Paragon International Limited is a company incorporated in the British Virgin Islands. Asia Paragon in turn wholly owns Delong Steel Limited. Delong Steel Limited, a Wholly Foreign –Owned Enterprise ("WFOE"), is an integrated steel mill manufacturing steel billets and mid-width hot-rolled coils for both domestic consumption and export.Delong Steel Limited in turn wholly owns Delong Yuntong Steel International Trading (Beijing) Co., Ltd, agent for import and export of steel products, mineral ores and related materials, as well as investment in resources-related projects.Dexin Steel Pte Ltd is a steel trading and procurement company incorporated in Singapore where its operation is located.